Are you considering offering group health insurance for 1099 employees? This option is a great benefit that your business can offer.

You need to examine the type of business you own. You may have independent contractors or W2 employees. This distinction will help to guide your decision.

Do you have a small business that needs contractors while you build your workforce? Is your business model one that benefits from using contract employees? Or do you have more hired workers?

It would be best if you had the right team to do the job when growing your business. Yet, the definition of a team in business has changed in today’s economy. Business owners now have more choices and flexibility. The purpose of a “team” has evolved. What that team looks like differs with each business.

Many small businesses may need help to afford a full-time staff. Instead, they may grow or supplement their team with contract workers. Many people work from home. This option allows businesses to use freelancers to get specific tasks done.

Workers have more choices on where and how they want to work. Thus, offering the right benefits can be the key to retaining and attracting workers. Providing a comprehensive health insurance policy for your workers will only benefit you.

So what is group health insurance? Should you offer this type of insurance for 1099 employees? What are the benefits of providing these benefits to contracted workers?

There are considerations when you offer group health insurance for 1099 employees. Offering group health insurance may work for some businesses but not for others. Cosmo Insurance Agency can help you to find the best insurance package. They will find the best fit for your company and employees.

What is Group Health Insurance?

Group health insurance is an insurance plan that an employer provides for employees. The employer, union, or other association can offer it. Group health insurance benefits are available for current employees of the company.

Employers must provide the same benefits to all employees regardless of age. By law, any business with twenty or more employees must offer group insurance. Group health insurance coverage allows several employees to sign up for health benefits. More people taking advantage of these plans can also lower the premiums people have to pay.

Group health insurance plans can include the following:

- Small or large employer-sponsored plans

- Self-insured plans

- Employee organizational plans

- National health plans

These plans do not include the following:

- Programs that only cover self-employed individuals

- COBRA coverage

- Coverage based on severance pay

- Health savings accounts

- VA coverage

The health plans offer options for health insurance coverage for all employees. You can provide group health insurance for 1099 employees. Yet, there are specific requirements that you must follow.

What are 1099 Employees?

A 1099 employee is an independent contractor and not a full-time employee. They do not work for the company and get hired for a specific task or period. These contracts can get renewed.

You get considered self-employed if you take an income but do not have employees. The IRS often designates contractors as “self-employed.” For tax purposes, they must fill out a 1099 form. These people usually do work on a contract basis. These independent contractors are not considered employees of the business in many states.

This option can become an issue when finding health insurance. Insurance can be costly when paying out-of-pocket. Many contractors have to take insurance into account when budgeting their income.

Luckily, there are ways for 1099 employees to get group health insurance. This option can benefit the person or company with whom they are in a contract agreement.

People that might enjoy group insurance for 1099 employees include:

- Real estate agents

- Hairstylists

- Freelancers

- Associations

- Truck Drivers

- Consultants

- Engineers

If you are a 1099 employee, you can gain group health insurance. Cosmo Insurance Agency can help you to find the best group health insurance policy to fit your needs.

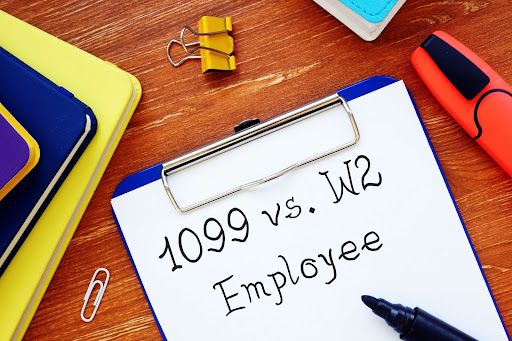

What is the Difference Between a 1099 Employee and a W2 Employee?

As mentioned above, contractors are 1099 employees. These contractors get paid for their services, which get recorded on 1099 forms. They are not considered an employee or incorporated into the business. If a person is not considered an actual business employee, they need this tax form.

In contrast, a full-time or part-time employee gets paid hourly or salary. They complete the tax forms called W2. This form reports wages, tips, and other compensation paid to employees. It also helps to determine social security and taxes withheld.

Many states and the IRS have rules to determine 1099 employees. There is a legal difference between W2 and 1099 employee status. These rules include the following:

- The amount of control the employer has on how a worker performs tasks

- The amount of instruction or training the worker receives from the employers.

- The specific job requirements provided by the employer

This distinction is essential for employers. Business owners tend to have more control over the terms of employment of W2 employees.

Also, many states only need business owners to offer the same benefits to 1099 employees. You must provide health benefits to W2 employees.

But, you can offer group health insurance for 1099 employees. In some cases, it may not be cost-effective to provide this benefit.

Many employers still choose to offer some benefits to 1099 employees. There are many good reasons for doing so. Cosmos Insurance Agency can help you find the best health insurance policy.

Can You Offer Health Insurance to 1099 Contractors?

There are many good reasons to offer group health insurance for 1099 employees. These reasons are like providing similar benefits for your W2 employees.