Understanding life insurance really comes from not only understanding what it is, but also what it can do for you. Many people don’t realize how flexible life insurance is or that it can serve as an all-in-one solution. You may have many different financial concerns and perhaps be unware that life insurance can actually be a solution for each of them – financial protection, wealth transfer, supplementing retirement income and saving for life’s big milestones. Because of its versatility, life insurance should be a part of every financial plan.

Life insurance isn’t complicated. Having a basic understanding of what it is and how it works can make a big difference in finding the product that provides the best solution for your needs. Let’s start with the facts.

Life insurance provides protection for your family or business.

The death benefit from a life insurance policy can help achieve many goals, such as:

• Ensuring your family is able to maintain their lifestyle

• Transferring wealth to the next generation, income-tax-free

• Keeping a business going

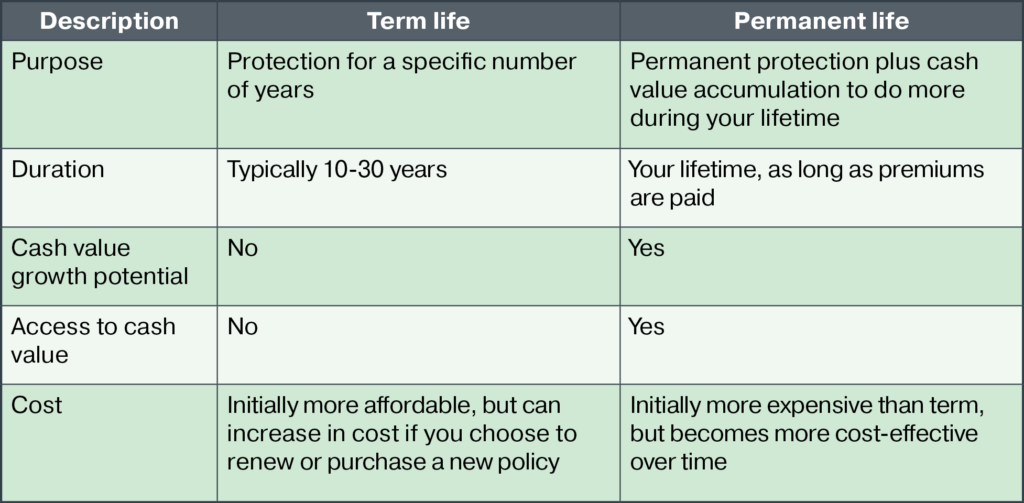

There are two types of life insurance: term and permanent.

Permanent life insurance can benefit you during your lifetime.

The cash value in a permanent life insurance policy can be used at any time, for any reason, during your lifetime — and, income-tax-free in most cases.

For example, you can use your policy’s cash value to:

• Pay for a loved one’s college education

• Turn that side hustle into a full-time business

• Fill an income gap in retirement

• Cover unexpected medical expenses

When people contemplate life insurance as a financial product or question the benefits it can offer, its important to keep in mind that all products exist for a reason. All products, even financial ones, are created to serve a specific purpose. At the end of the day that’s what they do. They provide a solution. Life insurance, just like any other type of insurance, is a promise. It’s an agreement that transfers risk from the client to the carrier. It’s an investment in your family’s future to help eliminate the risk that they could one day be left with nothing. Is that a risk you’re willing to take?

The right kind of life insurance, with the right amount of coverage, can help you achieve your goals at every stage of life. Work with your financial professional and talk through your options together.